A data-driven approach

About this project

Business needs

- Consult game investors on which game publisher to invest- Use sales & critic score of game.- Focus on rising publishers

Goals

- Propose criteria for choosing a game publisher

- Ensuring the interconnectivity between different visuals to showcase the metrics on different segments of the analysis

- Deliver key insights in easy manner

Conditions & Assumption

Only choose 3 publishers

Invest amount meets investor’s budget

Data source: Maven Analytics Game sales 2023

Data processing

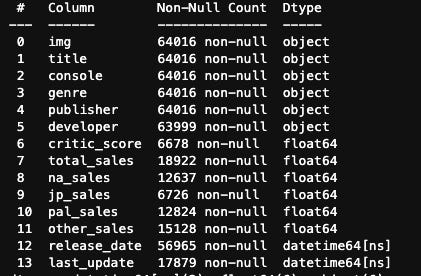

Given the provided dataset with following schema:

This table has 80% of total_sales are null. So I detected outliers of numerical values, trim and standardize them, together with categorical values (which were transformed into integers) as variables for KNNImputer to fill in Null values. Please refer to my git for source code. This step is simple but takes quite long.

Solution Crafting

The main information to use for decision making is sales, critic score and publisher.

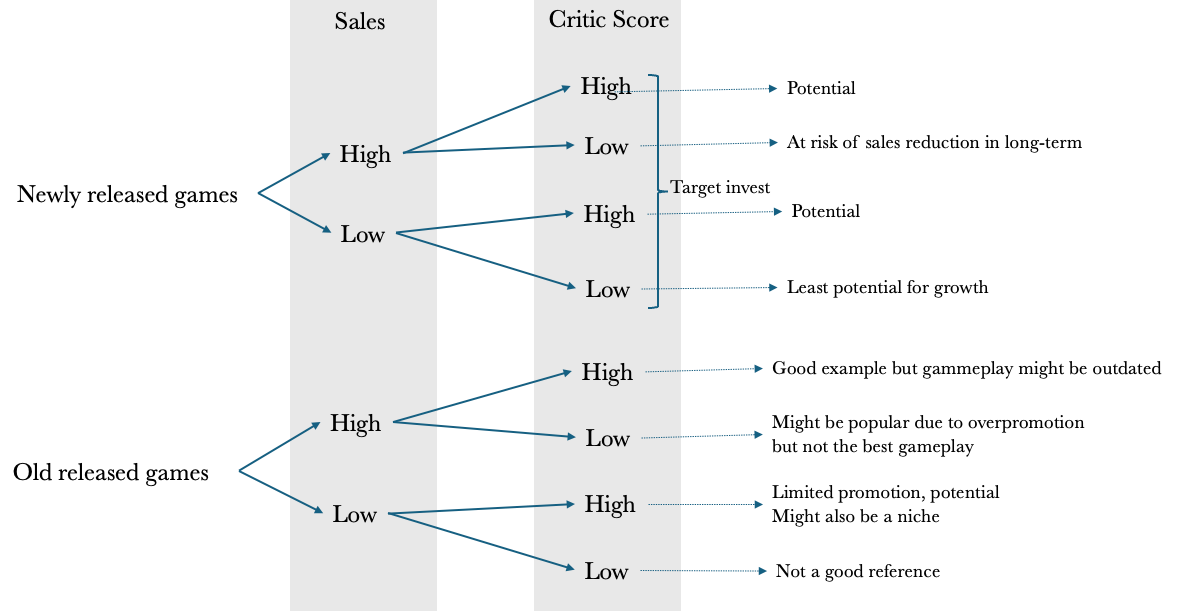

I then created an issue tree to support my direction:

Newly released games are defined as games released from 2010 and later, in contrast to old released games.

With the above rationales, I propose the following criteria to select publishers:

Publisher of newly published games

Games with high critic score

Limit sales but high sales per year

High-sales genres

High-sales games

The degree of high/low is compared with median game market for each segment (new/old games)

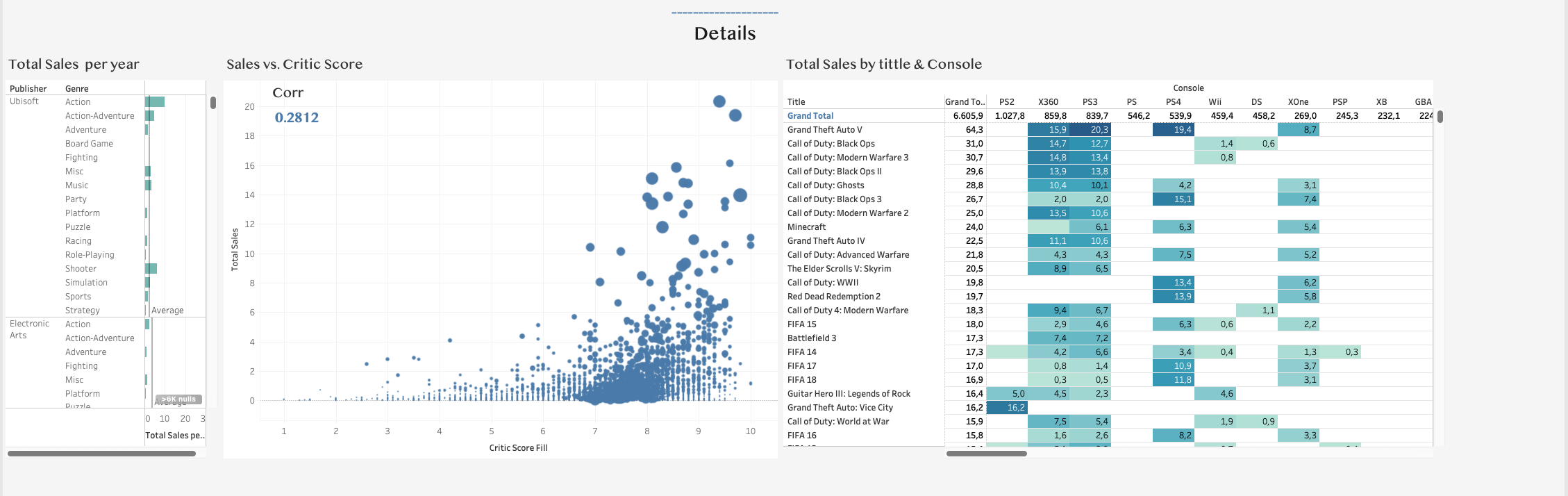

This analytic dashboard displays the sales by game properties (publisher, genre, title, console and critic score) as well as demonstrate the association between factors.

First of all, critic score has a considerable correlation with total sales. Hence, this variable should be included in criteria list, and furthermore, to evaluate the potential of the games of a publisher.

Under the requirement to invest in publishers with newly published games. I will only consider the publishers active from 2010 and later.

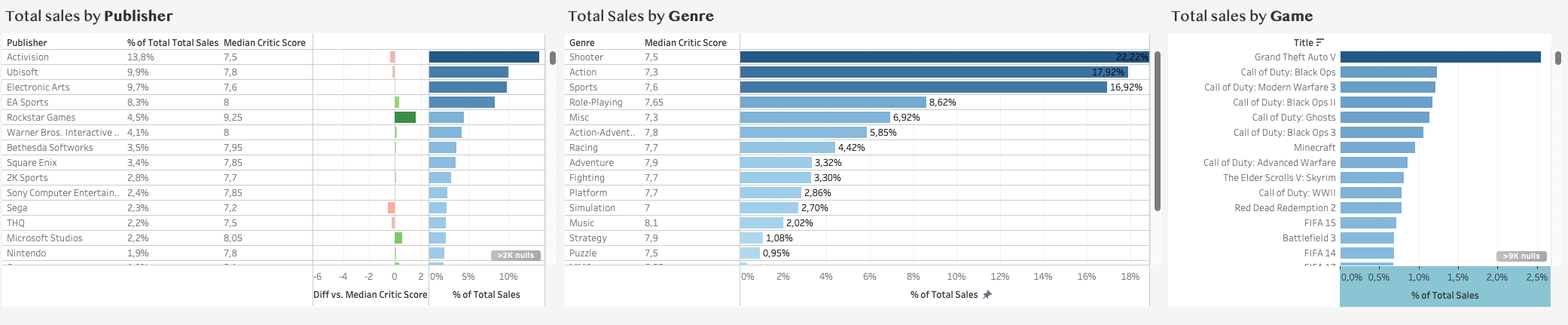

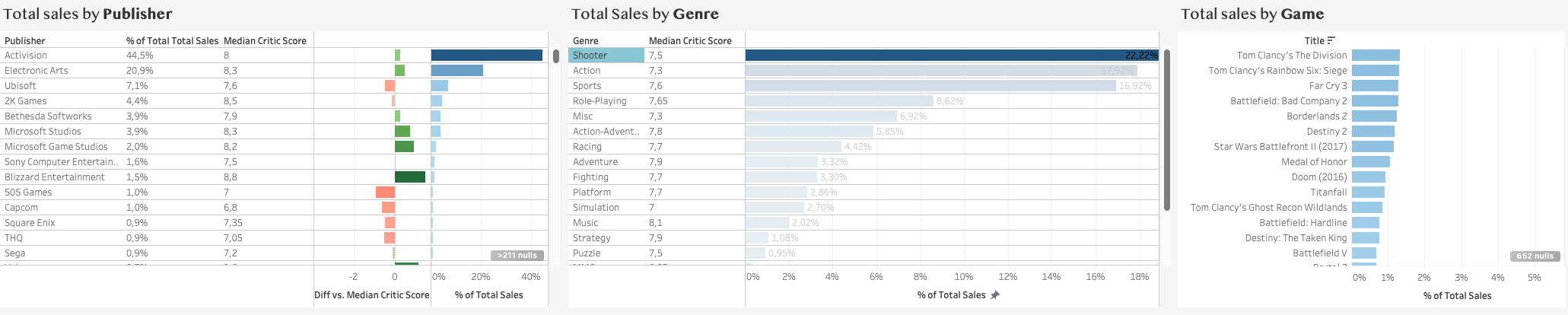

Looking at total sales by genres, Shooter, Action and Sport accounts for 57% of market sales - surpassing all other genre with games release from 2010. These 3 will be the focus for investigation.

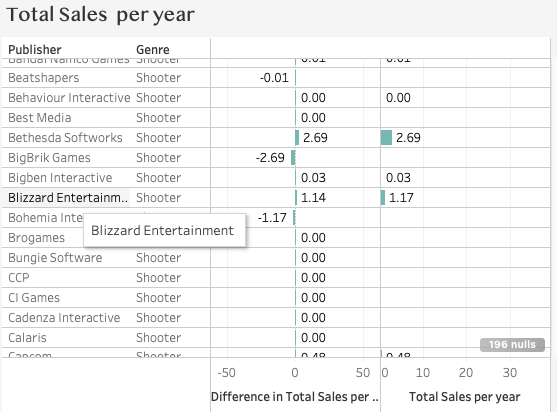

For shooter genre, Activision is leading the market with over 45% of total sales amount. Though it looks promising but Blizzard meets out criteria with 8.8 critic score. Its game titled Overwatch, though newly released in 2016, values at 8.18, which means sales per year is at 1.17 - 1.14 higher than Shooter genre market.

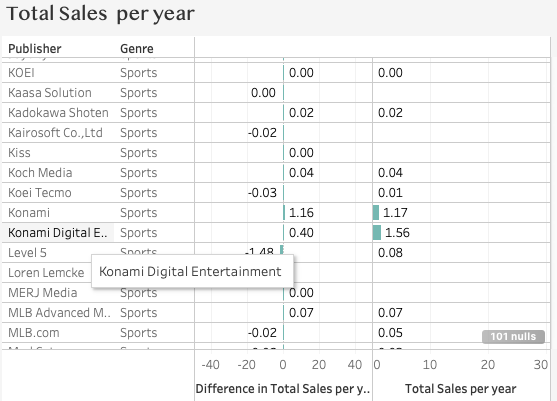

Konami Digital Entertainment is also a promising publisher in sport genre.

Its games received high critic score. The series Pro Evolution Soccer released in 2011 earned 1.56 per year, 0.4 points higher than average Sport genre market.

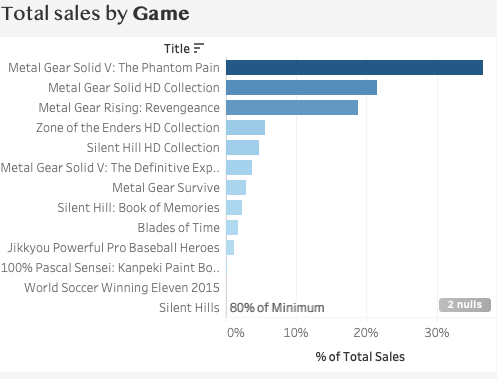

With Action genre, it’s undeniable that GTA series from Rockstar is truly a rockstar with outstanding critic score and sales performance. But we also see the Konami Digital Entertainment on the stage with 9. critic score.

Its series Metal gear - released in 2015 earned 1.163 points in sales per year. This would certainly the second choice after Rockstar.

Accordingly, we have found 3 publishers which meets out investment criteria: Blizzard Ent. (Shooter), Konami Digital Entertainment (Sport) and Rockstar Games (Action). Also, looking forward to the most anticipated game GTA VI in 2025 to be released by Rockstar Games.

Game

/game

Bài viết nổi bật khác

- Hot nhất

- Mới nhất